nh meals tax form

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

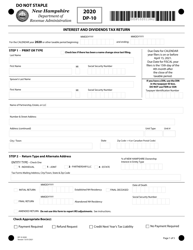

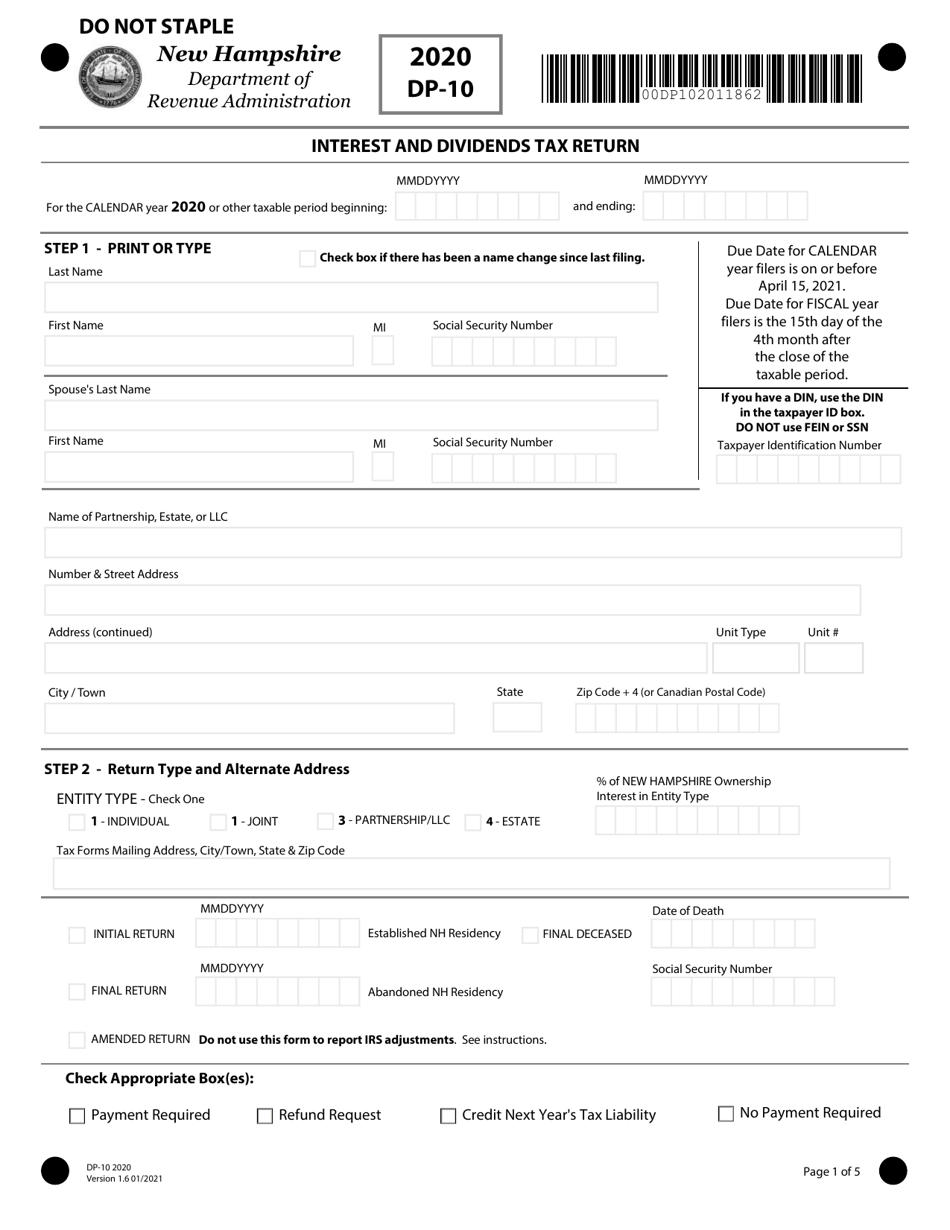

Form Dp 10 Download Fillable Pdf Or Fill Online Interest And Dividends Tax Return 2020 New Hampshire Templateroller

File this form at least 30-days prior to the start of business or the expiration date of the existing license.

. If prepared by a person other than the taxpayer this declaration is based on all. Business Location New Hampshire State Licenses Meals Tax Restaurant Tax City Lodging And Restaurant Tax Form F10 Modify Search City Lodging And Restaurant Tax Form F10 In all likelihood the City Lodging And Restaurant Tax Form F10 is not the only document you should review as you seek business license compliance in. Filing options - Granite Tax Connect.

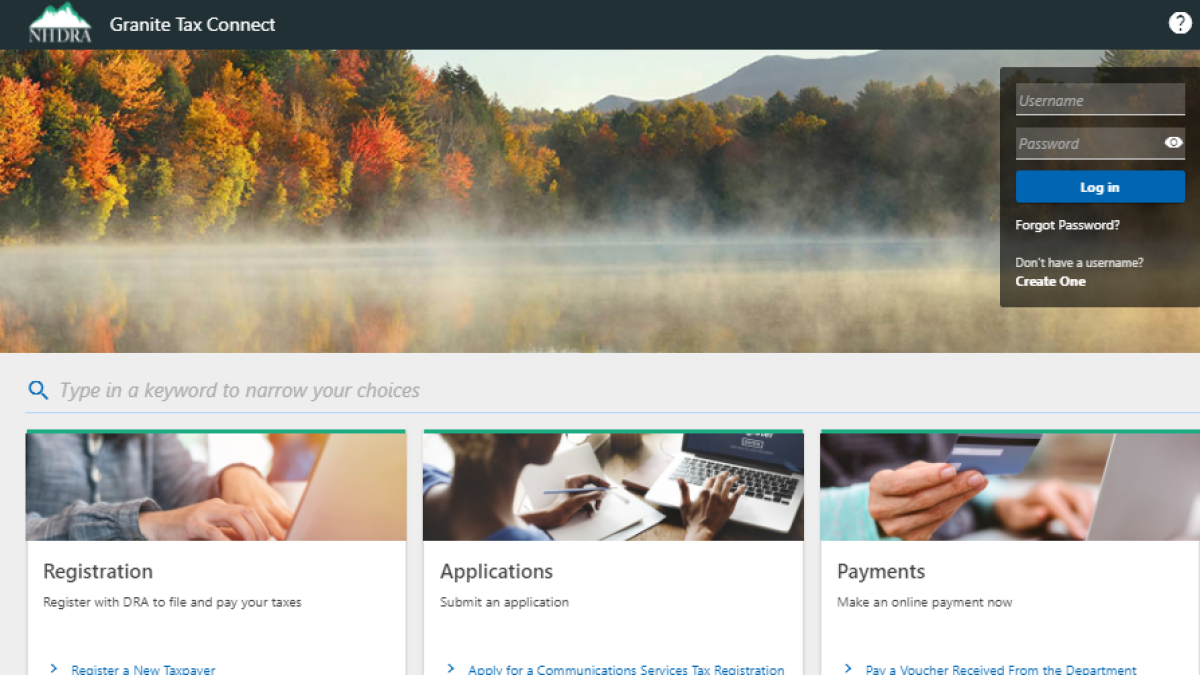

A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. Be sure to visit our website at revenuenhgovGTC to create your account access today. A 9 tax is also assessed on motor vehicle rentals.

2 NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION MEALS RENTALS TAX BOOKLET GENERAL INFORMATION MR General Info Rev 122015 FORM MR General Information MR TAX LICENSE REQUIREMENT The MR Tax is a tax assessed upon patrons of hotels restaurants and renters of motor vehicles based on the. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Portsmouth New Hampshire Meals Tax. Granite Tax Connect GTC is available for Meals Rentals Business Profits Business Enterprise Interest Dividends Communication Services Medicaid Enhancement Nursing Facility Quality Assessment Tobacco Real Estate Transfer Railroad Private Car and Utility Property taxpayers.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Exact tax amount may vary for different items. 2022 New Hampshire state sales tax.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. There are however several specific taxes levied on particular services or products.

There are three variants. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT. After that your nh meals and rooms tax form is ready.

MEALS RENTALS TAX RETURN Instructions Meals Rental Operators may file electronically on the Departments website at wwwrevenuenhgovgtc. Tax Returns Payments to be Filed. Create your eSignature and click Ok.

Rentals Tax and follow the prompts. Date of filing is the date this form is either hand delivered to the municipality postmarked by the post office or receipted by an overnight delivery service. Please visit GRANITE TAX CONNECT to create or access your existing account.

New Hampshire is one of the few states with no statewide sales tax. File this application with the municipality by the deadline see below. Utility Property Tax.

Follow the step-by-step instructions below to eSign your nh dp14. CHECK the AMENDED RETURN box if you are filing to make changes or corrections to a previously filed DP-14 for any ONE taxable period. A typed drawn or uploaded signature.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax. Motor Vehicle Bill of Sale.

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION MEALS RENTALS TAX RETURN BUSINESS NAME. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered. Select the document you want to sign and click Upload.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. File this form at least 30-days prior to the start of business or the expiration date of the existing license. If you have questions call 603 230-5920.

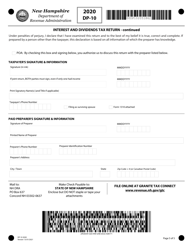

NH DRA DOCUMENT PROCESSING DIVISION PO BOX 2035 CONCORD NH 03302-2035 Under penalties of perjury I declare that I have examined this form and to the best of my belief it is true correct and complete. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

The notice of tax means the date the board of tax and land appeals BTLA determines the. NH DRA PO Box 454 Concord NH 03302-0454. MEALS RENTALS TAX RETURN MAIL TO.

A Portsmouth New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. WHERE TO FILE Mail to. NH DEPT OF REVENUE ADMINISTRATION DOCUMENT PROCESSING DIVISION PO BOX 2035 CONCORD NH 03302-2035 Under penalties of perjury I declare that I have examined this form and to the best of my belief it is true correct and complete.

Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served the holder of the license is. The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. NH DRA DOCUMENT PROCESSING DIVISION PO BOX 2035 CONCORD NH 03302-2035 Under penalties of perjury I declare that I have examined this form and to the best of my belief it is true correct and complete. A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year.

Decide on what kind of eSignature to create. NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION MEALS RENTALS TAX RETURN BUSINESS NAME. Town ClerkTax Forms.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. NH DRA PO Box 454 Concord NH 03302-0454. The meals tax rate is 625.

603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301.

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

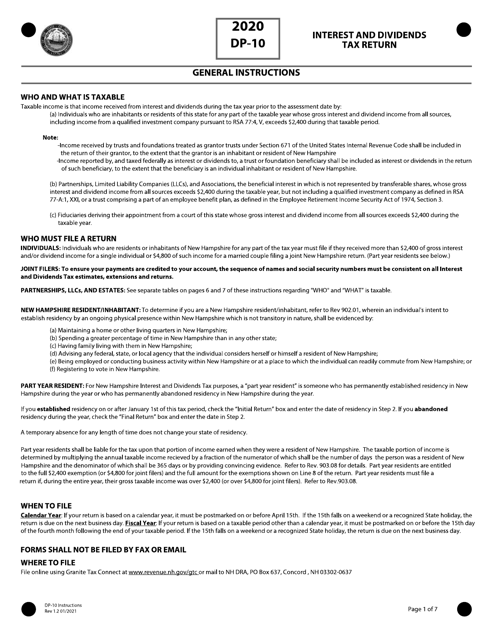

Download Instructions For Form Dp 10 Interest And Dividends Tax Return Pdf 2020 Templateroller

Keene Nh Pumpkin Festival So Many Pumpkins Lit All At Once World Records Baby Pumpkin Lights Pumpkin Festival World

Commander S Palace In New Orleans Try Before You Die Top 16 Iconic Southern Restaurants See More At Southern Restaurant How To Cook Pork Asian Street Food

Nh Dept Of Revenue Administration Launches New Online User Portal For Paying Taxes And More Manchester Ink Link

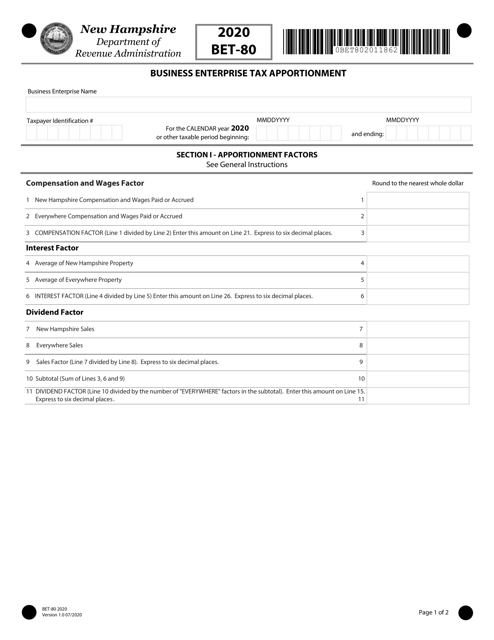

Form Bet 80 Download Fillable Pdf Or Fill Online Business Enterprise Tax Apportionment 2020 New Hampshire Templateroller

Form Dp 10 Download Fillable Pdf Or Fill Online Interest And Dividends Tax Return 2020 New Hampshire Templateroller

Form Dp 10 Download Fillable Pdf Or Fill Online Interest And Dividends Tax Return 2020 New Hampshire Templateroller

Big Companies Landed Paycheck Protection Program Loans And They Ll Be Back For More Shake Shack Shake Shack Burger Shack Burger

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Incorporate In New Hampshire Do Business The Right Way

New Hampshire Meals And Rooms Tax Rate Cut Begins

New Hampshire Details Map Large Printable High Resolution And Standard Map Whatsanswer Detailed Map New Hampshire Large Printable

Hoss And Mary S In Maine Makes Incredible Burgers The Incredibles Maine Mary

New Hampshire Revenue Dept Launches Final Phase Of Tax System

What I Learned Doing My Own Tax Return Real Advice Gal Tax Return Diy Taxes Income Tax Return

New Hampshire Income Tax Nh State Tax Calculator Community Tax